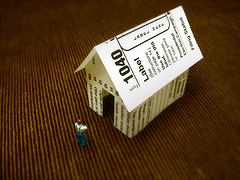

We’re definitely in the middle of tax time here in America, and most people are stressing about one of two things: how much they’re going to have to pay to Uncle Sam or how much he’s going to be giving back. No matter which camp you’re in, it’s always stressful to have to do a financial recap of your whole year while juggling receipts, donation stubs, and all the other joys of tax preparation.

The last thing you want (or need) during tax time is to be hit with some kind of tax scam. You know what I’m talking about; you’ve probably heard your local news mention something about it in a blurb between stories.

I could probably give you a whole slew of advice on how to avoid tax scams like we did last year with our blog post about “IRS tax and refund scams“, but I’m going to be distilling it even further this year and only give you two. The number of tips may seem a little thin, but you’ll see that these two scams account for the majority of all phishing/etc. attempts at tax time.

- Email scams:

These are rising in popularity across the board with scammers. Email is so cheap and easy to spread that they can send out millions with the push of a button. Be smart: know who the sender of an email is, and be careful about clicking on any links from emails. It’s not too difficult to create a convincing looking email. My suggestion is that if an email looks legit, trust but verify; Contact the agency that contacts you. And if it is a scam, report it to the IRS.

- Website scams:

These should be easier to discern because if the domain name doesn’t end with “irs.gov” (or at the very least the “.gov” part, since only government agencies can register those domains), then it’s very likely a scam. The IRS and other government offices may direct you to a .com website for informational purposes, but never for anything important wherein you’d be requested to enter personal information. Be sure let the IRS know if you find a possible scam site by reporting tax scam web sites to them.

As a general rule of thumb, the IRS won’t contact taxpayers individually via unsolicited email. And more importantly, they aren’t going to be asking for your Social Security Number, your PIN numbers, or any other sort of personal financial information in said email.

If you're looking for great anti-virus software that won't break the bank, try StopSign. You don't pay extra for tech support for difficult malware, and our web protection software just works. Download & install StopSign to find out why our members choose us over the other options.

Recent Blog Comments